Rockwell Q3 Sales, Prices and Production Improve, But Still In the Red

January 16, 11

|

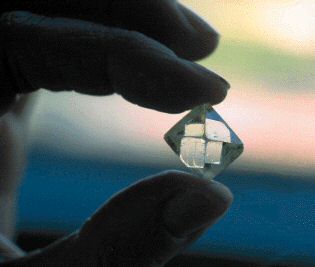

Rough diamond sales of $10.2 million averaged $1,566 p/c compared to $1,048 p/c in the second quarter.

During the third quarter, Rockwell recovered eight large gemstones from its Holpan, Klipdam and Saxendrift operations, bringing the total number of plus 50-carat stones recovered in its current fiscal year to nineteen. In addition to recovering several high quality white and fancy yellow colored gemstones, the following notable diamonds were also produced:

83-carat sawable diamond, with a slight yellow tint with a small spot;

84-carat industrial quality diamond;

63-carat sawable, white diamond with a few spots throughout the stone;

50-carat makeable shape, clean D color diamond; and

72-carat makeable shape, clean H color diamond.

In the nine months to November 30, 2010, Rockwell produced 22,519 carats of diamonds compared to 19,920 carats produced during the same period in the previous year. The average price achieved over the nine months of fiscal 2011 is $1,345 p/c, a significant increase from the $969 p/c received in the previous year.

The company said that the recovery of the global diamond market gained momentum with prices reaching the 2008 levels and jewelry retail sales have been higher than major retailers have expected. “These sales will support a reduction in polished inventory and, consequently, could fuel the trade of rough diamonds,” the company stated.

Rockwell is focused on the mining and development of alluvial diamond deposits in the Northern Cape Province area of South Africa. The company operates three mines - Holpan, Klipdam and Saxendrift - and a bulk sampling evaluation program on the Klipdam Extension property near to the Klipdam operation.