2010: Year of Replenishment, Speculation and Recycling

May 11, 11

|

|

The contrasts between 2009 and 2010 could not be starker, but, in all fairness, the pipeline behaved as predicted. Coming after 2009, which reflected the most severe single-year contraction of the diamond pipeline since World War II owing to the economic crisis and the resultant liquidity shortages, the industry managed the crisis remarkably well, and a “freefall” of prices and the feared spate of bankruptcies and/or insolvencies were avoided.

Industry participants understood that the severity of the contraction was the logical result of the reverse ripple effect – the process of severe destocking at all levels of the pipeline, which reduced the demand for “new goods” at entry level. This culminated in about a 50% reduction in rough supplies into the pipeline.

In 2010, the ripple effect operated in a forward mode (actually starting already in the fourth quarter of 2009) and, consequently, cutting centers saw enormous growth in sales – as all phases in the pipeline were replenishing.

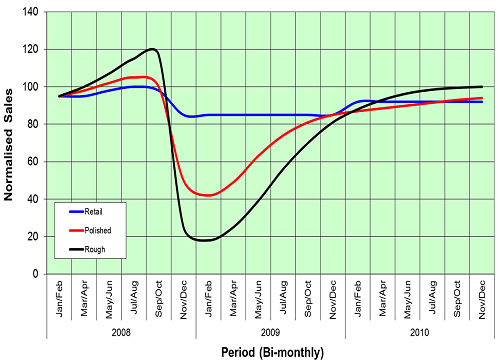

The demand has not (yet) originated from a dramatic return of consumers to the shops. What is probably the most outstanding feature is the fact that – on the demand side – we saw a return to a restored equilibrium between polished, rough and retail demand. It was the insufficient supply of rough that, among other things, partly triggered havoc in rough pricing.

If we assume that at the end of 2007, well before the problematic 2008 year, the three demand parameters were in balance, we can see from the table below that from a demand perspective, 2010 was back to normal – an outstanding achievement any which way one looks at it.

|

|

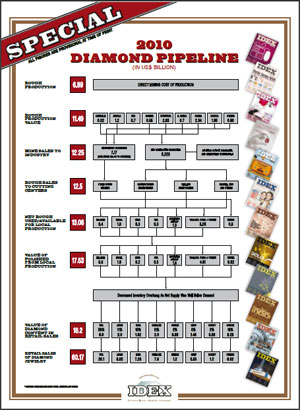

The only way to view the relevant parameters of the 2010 pipeline is by seeing it in a multi-year perspective. The economic modeling, which forms the basis of our forecasts, and which we have developed in conjunction with Pranay Narvekar of Mumbai’s “Pharos Beam” consultancy, predicts that the high growth figures on the polished and rough sides will not be sustainable through 2011. This is all the logical and rational result of the forward ripple effect.

Diamond Industry Is Demand Driven

The 2010 performance of the three most critical parameters: consumer (retail) demand, cutting center sales and rough demand, clearly highlights the year’s impressive performance. After two consecutive years in which global retail demand declined by some 9% and 9.5% respectively, in 2010 the tide turned and retailers sold 6.8% more (in US$ terms). This is, however, still 12% below the 2007 demand level. De Beers, which has its own mysterious ways of arriving at market figures, estimates the year’s diamond jewelry growth as well as the diamond content (in polished wholesale prices – pwp) both at 8%; in the same ballpark as our estimates.

In 2011 we expect consumer demand to step up the speed of recovery and grow by 9.6% over 2010. Though certainly impressive by itself, sales will still be some 3.6% below the 2007 levels.

In terms of individual country growth, the star performers on the retail levels were

In our 2010 Tacy Ltd. Diamond Pipeline, we are also presenting the relative market share of diamonds (measured in pwp) in each market – these figures may be quite different from the diamond jewelry sales (depending on other inputs such as gold, design, overhead, etc.). The diamond content in jewelry differs from country to country. We estimate the

| Industry Stabilizes in 2010

|

The real excitement in 2010 was at the cutting center levels. Because of the reverse ripple effect, in 2009 cutting center supplies of polished were down 27%. This process took a dramatic U-turn, and an enormous 38% jump was recorded in 2010 when trade optimism triggered the forward ripple effect. It must be stressed that market research is an “ongoing” process and figures are constantly revalidated and revised, when necessary. The table in this article reflects the latest figures (end April 2011) and our $18.2 billion for global polished consumption has been revised to $18.9 billion. This difference is mostly of a psychological nature: in the cutting centers we have just exceeded the 2008 performance.

The good news will continue, albeit at a lower pace. The 2011 cutting center sales will grow by a further 14.3% and global diamond sales (expressed in pwp) will reach $21.6 billion.

A major question is where will the rough needed to supply the expected polished demand come from. That was the issue in 2010 and will remain a major concern in 2011.

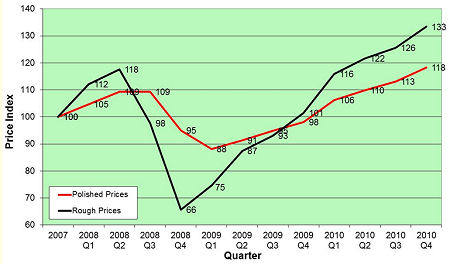

The Tacy Ltd. pipeline shows that some $12.25 billion worth of rough was supplied by the producers to the industry. Our estimates show rough demand of $13.4 billion. How was the demand met? Largely through price increases while exacerbating the “shortages sentiment” – i.e. the world is running out of diamonds. Don’t hold your breath yet. The producers very calculatedly undersupplied the markets in 2010. The result was a 27% price increase in rough during 2010, a trend that continues in 2011. (Interestingly or rather maddingly, a March 2011 De Beers Group strategy paper notes that the “world $ pwp growth of approximately 8% was higher than expected by markets – as a result the diamond pipeline was under supplied at the start of 2011.)

This “undershooting” of market demand by the producers might be “forgiven” given the fact that in 2009 their supplies to the market were drastically cut by some 45% from $13.4 billion to merely $7.5 billion. In 2010, demand increased a hefty 77%, bringing it back to the 2008 levels. The market could have absorbed more. In 2011 we expect a further rough supply growth of 21.5%, raising rough supplies to $16.2 billion. The lion’s share of this increase comes from price appreciation rather than from carat growth. The graph below shows the price evolution of rough and polished prices.

| Composite Diamond Price Index for All Qualities and Sizes

|

Declining Carat Volumes Impact Trade Sentiment

The Tacy Ltd. pipeline doesn’t actually record the rough and polished movements in terms of carats. In 2009, by any standard the industry’s most difficult crisis year, the world’s diamond producers mined some 120-125 million carats (Mct) valued at $8.6-$9.5 billion, a steep reduction from the 160-165 million carats worth $13.4-$14.4 billion in 2008. In 2010, it is estimated that the mines produced 125-130 million carats, valued at $11.8-$12.2 billion. As the Russian government stocked the output, these goods did not enter into the market. Trade sentiment is influenced by a growing awareness within the industry of an approaching supply demand deficit, even after mines resume full production and sales.

While the outlook for diamond demand is favorable, growth in rough diamond production is slowing as reserves are being depleted and no new major mines have come on stream. Tacy Ltd. forecasts that, up to 2020, annual rough supply will hover around a much lower 120-130 million carat level, without taking the “wild card” called

Conventional wisdom has not yet considered the possible impact of the Marange production, which may add 20-30 million carats of mostly lower quality goods to the market. There is still uncertainty whether this production will be viewed as part of the “legitimate” diamond market. In any scenario, it will impact cutting-center employment in

2010: Market Value of Global Diamond Recycling Estimated At $6 Billion

What the pipeline does not fully capture (yet) is the impact of recycling. The figure would, implicitly, be included in the cutting center sales to the market, specifically sales from

To put the rather new recycling issue in perspective, we have written before that since ancient days the world has produced some 5.2 billion carats of diamonds – which, at today’s rough production values, $80 p/c, would amount to $420 billion of rough. The historically adjusted gem quality polished output would be between 1.3-1.8 billion carats, taking into account the specific and limited range of goods that used to enter the gem quality market. At today’s polished prices (average $650 p/c), consumers hold about $0.9-1.2 trillion worth of polished – between 40-50% of which would be in American hands. Recycling of even a small part of this “stock” can significantly affect demand for fresh polished and, consequently, rough demand. Moreover, only the “better” qualities are recycled.

There is hard evidence that considerable recycling has taken place in 2010. One eminent expert in the

Our sources say the widely accepted “recycling” standard price is 80% below Rapaport, at most. Thus the potential profits to be made in this market niche are huge. My sources estimate that “in the

How can we put a price tag on this activity? The average value of

As economic hardship, divorces, etc., are not the sole prerogative of the

How does this impact the pipeline? In a most direct way, this amount would be the equivalent of some $4 billion of rough – significantly softening the demand for rough and, potentially, a factor that might suppress rough prices, which is not something we see today. We assume that these goods are still largely held in inventories in the diamond centers.

According to a prominent representative of

So far we have collected considerable anecdotal evidence on the recycling phenomenon and are aware that many diamond traders are developing this market niche. It is very much a “quiet” branch of the business, not always recorded – and certainly not a subject “selling consumers” will readily discuss.

The Investment Market Is Emerging Again

Part of the global consumption comes from the remerging investment diamond market – where diamonds enjoy a ride on the fringes of the staggering prices of gold and silver.

A pivotal juncture in the investment market was reached in early 2009, when then De Beers managing director, Gareth Penny, conducted “road shows” in the Gulf countries, trying to generate demand for Arab investments in rough diamond stocks (In some of the projected scenarios, these stocks would at some point be polished through joint ventures with De Beers.) The efforts were not successful, but did give a powerful message to the industry: investment diamonds are now viewed as a legitimate part of our business, reversing a time-honored policy of claiming that diamonds are only meant for adornment – the diamond jewelry markets.

Investment-oriented purchases of diamonds first became truly popular in the late 1970s when good quality diamonds reached extraordinarily high price levels. During the following price recession, in the early 1980s, this demand dwindled and most of the investment companies went bankrupt.

Now, the investment market is again becoming a factor, not because of current prices but solely based on expectations of future supply shortages and resultant price appreciation. Moreover, many investors have lost their faith in the banking system and prefer to hoard their assets in a discrete safe, rather than in a discrete bank account – the details of which eventually reach the fiscal authorities. In the past, diamonds rarely provided a satisfactory rate of return. In today’s environment – diamonds are safe, discrete and the supply shortage places them as unique investment opportunities.

Anecdotal evidence indicates that in 2010 there were several funds (supported by Swiss bankers) in the process of buying – or planning to buy – better polished in the market. A typical fund may aim at $200-$300 million portfolios of physical diamonds.

Today, in May 2011 and after the crisis, we can say that rough prices have once again exceeded their previous historical high levels and set new records. The price volatility is, of course, attractive to an investment market if it can buy and sell with little overhead on the wholesale market. The higher prices will also cause the “recycling” trend to gain momentum and make it a permanent feature of the business.

The days in which every diamond ring originated from a recently mined rough diamond may be over – and we may have to rethink our 2011 diamond pipeline, where billions of dollars’ worth of diamonds may come from yet unclearly defined “other sources.” In a way, the world’s biggest “diamond mine” may now have been discovered. Let’s call it the “Happy Recycling Mine of the