IDEX Online Research: Jewelry Consumer Prices -1.4% in November

January 01, 13

(IDEX Online News) – Capitalism is at work in the

The full analysis

Faced with slowing sales, retail specialty jewelers in the

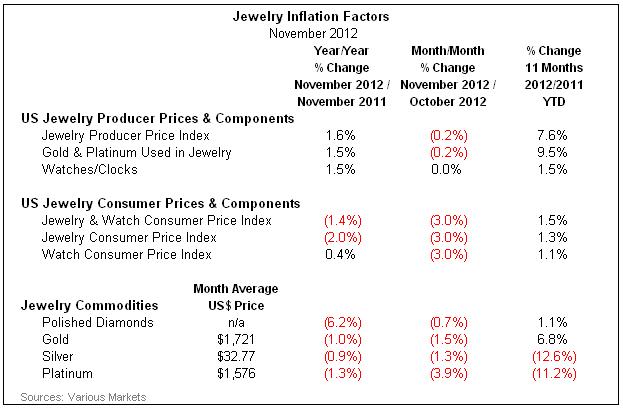

In contrast, suppliers’ prices continued to edge upward, but at a much slower rate than in the recent past.

Two factors are behind jewelry’s slowing inflation rate, especially at the supplier level: 1) encouraging economic data has caused some investors to move out of precious metals and back into other assets such as equities and other paper financial instruments; and, 2) weak demand for diamond jewelry has kept a lid on polished diamond prices.

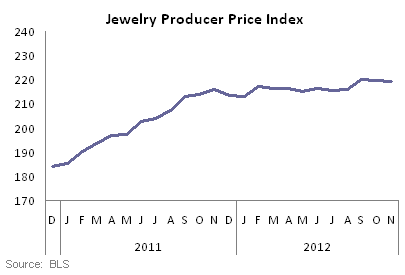

WHOLESALE: Jewelry Prices Up Modestly in November

The graph below summarizes the JPPI over the past two years. The sharp upward turn in inflation in September and October is clearly shown on the graph.

|

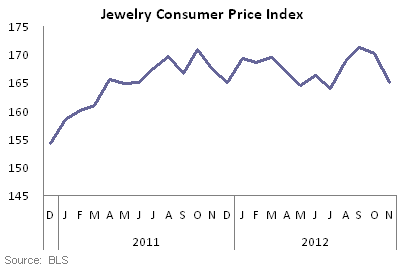

RETAIL: Jewelry & Watch Prices Fall in November

The graph below summarizes the JCPI over the past two years:

|

The table below provides detailed inflation / deflation rates for jewelry components as well as inflation rates at various levels of the jewelry distribution channel in the

|

The Big Picture: Will Lower Prices Boost Demand?

Early in 2012, retail jewelers were hesitant to raise their retail prices, since jewelry demand was relatively weak. However, in the face of rising wholesale prices, jewelers felt compelled to raise prices for jewelry that contained gold, silver and platinum. Those retail merchants were betting that jewelry demand will not be affected significantly. Further, they wanted to test the market with higher prices prior to the all-important holiday selling season.

As it turned out, fundamental consumer demand for jewelry has remained tepid, and it could be argued that higher retail prices have driven some shoppers away from jewelry.

Will lower prices at jewelers help boost demand, especially so close to the holiday shopping season? Probably not. There are far too many competing products to attract shoppers, especially exciting consumer electronics merchandise at retail prices $200-500, the “sweet spot” for Christmas jewelry. Thus, jewelers’ price-based promotions are probably falling on “deaf ears,” and profits will suffer.

Jewelry Inflation Outlook Unchanged: Moderate Inflation in 2012

Our outlook for jewelry price inflation remains unchanged: jewelry prices are expected to move modestly higher at all levels of the distribution channel in 2012. However, the rate of inflation is expected to be well below 2011’s torrid pace, both at the supplier level and at the retail level.

The full analysis and statistics on jewelry industry inflation for November 2012 is available to IDEX Online Research subscribers and IDEX Online members