IDEX Online Research: US Producer Prices Drop in July

August 26, 14

(IDEX Online News) – American retail jewelry prices rose in July from the month before, while producer prices dropped.

That’s counter to the historical trend. Normally, jewelers raise their prices during the slow summer months so they can discount them in the fall and holiday selling season (retail regulations suggest that a merchant must offer goods at “regular retail” prices for a period of time before they can claim an “honest” discount).

Producer prices are another story. It is likely the government got the numbers wrong in July. They showed that producer prices fell by 6.3 percent, driven mostly by a highly unusual decline in the price of precious metal jewelry (mostly gold and platinum) of 10.4 percent.

Those numbers are preliminary, and are likely to be revised. When looking at the prices of the underlying components of jewelry — diamonds, gold, platinum — they have been more or less steady this year (diamonds have shown a rise in prices, but not enough to flow through to retail yet). So, there is no good reason for producer prices to post such a sharp decline in July.

Some may suggest that both producers and retail merchants are reducing prices in an effort to boost consumer consumption, however we don’t think that’s the case, because even in the tough 2007-2010 recessionary period, we didn’t see any real attempt by jewelers to boost jewelry demand via price elasticity. In short, we believe there’s a problem with the government numbers, and we’ll see revisions soon.

JCPI Rises in July

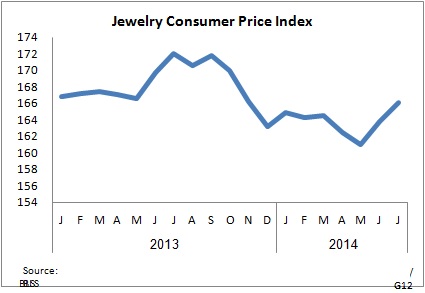

For July 2014, the Jewelry Consumer Price Index (JCPI) stood at 166.1 compared with 163.8 in June. Here’s what this means:

· Retail prices of jewelry rose on a month-to-month basis.

· Retail jewelry prices decreased by less than two percent on a year-to-year basis: July 2014 versus July 2013.

The graph below indicates the changes in the JCPI over the past two years. There was a great deal of volatility for most of the period, with a low point reached in May 2014.

JPPI Declines in June

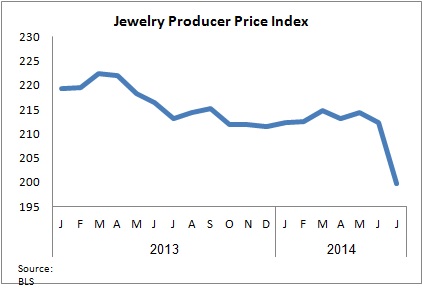

For July 2014, the Jewelry Producer Price Index (JPPI) came in at 199.8 compared with 212.4 for the month before. Here’s what this means:

Wholesale jewelry prices plunged on a month-to-month basis: July 2014 versus June 2014.

However, wholesale jewelry prices are way below the July 2013 figure on a year-to-year comparison basis: July 2014 versus July 2013.

The graph below summarizes monthly JPPI over the past two years.

Looking at producer prices, they were more or less unchanged from July last year until May 2014.

Outlook – Inflation Likely To Remain Modest

As mentioned, retail jewelers are acting in line with the usual cyclical trends: raising prices in the summer months which are, in any case, a slow period in order to give themselves room to ‘discount’ prices later in the year ahead of the holiday sales season.

As the United States economy shows signs of taking off, the inflation environment remains benign. The Federal Reserve’s continuing relaxed monetary policy aimed at stimulating growth is continuing to boost a feel-good effect as house and stock prices continue to rise.

For 2014, analysts forecast a rise in the CPI to 2.0 percent from around 1.2 percent in recent times.

The ongoing battle between consumers and retailers continues to see buyers in the driving seat.