IDEX Online Research: Decline In Polished Prices In October

November 10, 14

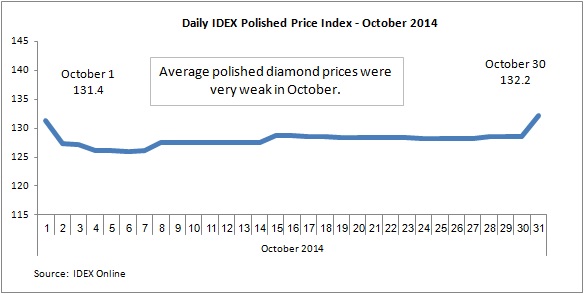

(IDEX Online) – The IDEX Online Polished Diamond Index decreased in October to 128.1 from 133.1 in September. While prices did pick up notably on the last day of the month they were weak during the rest of the month. In round items, all sizes showed decreases. The full analysis of the jewelry sales data is available to IDEX Online Research subscribers and IDEX Online members here. The IDEX Online Polished Diamond Index began October at 131.4 and ended the month at 132.2 as is seen in the graph below. There were declines throughout the month before rising on the last day of October.

Looking at the long-term view of polished diamond prices, there has been a decline since the summer months, and the index is heading for the levels seen in early 2011. A period of two years when the index was largely flat appears to have come to an end with the index having started to decline last July.

The drop in prices over the summer months can be seen as the traditional behavior expected and is seasonal in its nature due to the summer vacations and lower levels of trading. However, with the Christmas sales season about to kick in, manufacturers and wholesalers would have been hoping to see stronger prices starting at this time.

There was a month-on-month fall in prices in October. Prices of all sizes of polished diamonds declined.

Comparing prices with October last year, there were declines for 4.0-carat items which can be attributed to the high impact of relatively low levels of activity in that size of diamond, while there were very decreases in smaller stones, too.

Looking at the performances of all these categories together since January last year in the Index of Round Diamond Price Trends by Size graph below, there appears to be a downward trend in all diamond sizes.

Outlook

Given the macro outlook, perhaps it should not come as a surprise that prices declined in October. Manufacturers, certainly in India, according to sources, were selling off inventory in a bid to raise cash as a result of a tight liquidity situation.

The Jewish holidays affecting Israel, Belgium and New York, and then the important and lengthy Diwali holiday in India, also hit demand.

Adding to that, and completing a not very virtuous circle, with the market clearly heading in a downward direction, some buyers may well have stepped out of the ring and decided not to fill large orders in the belief that diamond prices had further to fall – a sort of deflation impact on diamond prices.

As for the coming months, will the U.S. market require large updates of polished goods so close to the Christmas sales season?. That leaves China and India. In China, the Chinese New Year is likely to lead to a rise in demand, but in India there appears to be a large overhang of goods which means demand there might be marginal.

Click here for more information on how to subscribe to Research items or become a member.