IDEX Online Research: US Jewelry Retail Prices Down, Supplier Prices Up

December 23, 14

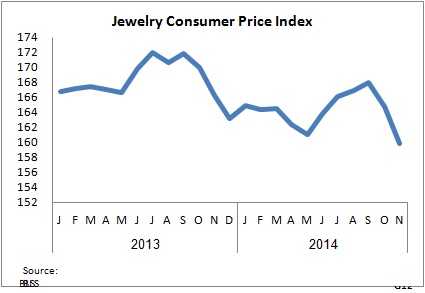

(IDEX Online News) – The Jewelry Consumer Price Index (JCPI) continued to decline sharply in November, driven by price-based promotions and heavy discounting at retail stores which sell jewelry. Based on new data from the government, retail jewelry prices were at the lowest level of the year in November, as the graph below illustrates.

Click here to read the complete Research section article.

In contrast to the JCPI, the Jewelry Producer Price Index (JPPI) rose modestly in November as jewelry suppliers raised prices.

The U.S. Consumer Price Index for all items – retail prices – also fell modestly in November: down 0.3 percent. Thus, it is no surprise that jewelry prices also fell during the month. Consumer demand has been softer than expected in the second half of the year, and retail merchants have used price-based promotions to drive customer traffic and sales.

When suppliers’ jewelry prices rise, but retail merchants’ prices fall, it creates a profit squeeze for jewelry retailers. There are only a couple of reasonable outcomes to this situation: either retailers will raise their prices or suppliers will roll back their price increases.

In November, fine jewelry and watch retail prices were down by 3.8 percent on a year-over-year basis. Jewelry retail prices (excluding watches) were down by 5.0 percent in November 2014 versus the same month a year ago. On a month-to-month basis, fine jewelry and watch prices were 3 percent lower in November than in October, while jewelry (ex-watches) prices were down by 3.1 percent.

Jewelry Suppliers’ Prices Are Down Sharply This Year

In November, jewelry suppliers’ prices were down 6.8 percent from November 2013 levels. Supplier prices for precious metal jewelry were down 8.5 percent in November versus the same month last year. However, on a month-to-month basis, supplier prices rose by 1.1 percent in November from October levels. Precious metal prices rose by 2.6 percent in November versus October. November’s month-to-month price increase by jewelry suppliers was the largest monthly gain this year.

Precious Metal Prices Fell In November, But Supplier Prices Rose

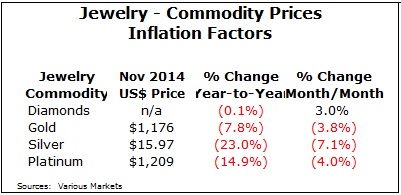

While polished diamond prices showed some hint of a price increase in November, all three key precious metals used in jewelry – gold, silver, and platinum – posted lower prices, both on a year-to-year basis and a month-to-month basis, as the table below illustrates.

Based on the data about precious metal prices in the table above – and based on stable labor costs, especially in the U.S. market – there is no justification for jewelry suppliers to raise their prices for precious metal jewelry, the category which posted the largest price increase in November. In part, suppliers may be trying to recover from price deflation which has been underway for about a year and a half. However, suppliers’ prices have not fallen nearly as much as the underlying precious metal commodities.

Click here for more information on how to subscribe to Research items or become a member.