IDEX Online Research: US Producer Prices Revised Downwards

September 30, 14

(IDEX Online News) – The big story in the Jewelry Producer Price Index (JPPI) in August was the significant government revisions for the JPPI readings for March and April.

The full analysis of the jewelry sales data is available to IDEX Online Research subscribers and IDEX Online members here.

This, apparently, was due to prices of precious metals which dropped substantially in January and February. It seems that it takes 60-90 days for changes in the cost of materials to work their way through to manufacturers’ costs and prices.

It's also possible that there will be further revisions in the coming months, since the government’s “preliminary” estimates for March and April were way off.

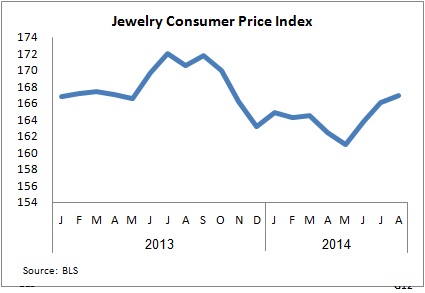

Looking at American retail jewelry prices, they rose again in August, continuing an upward trend that began in March. That would seem to be in line with the historical trend, since jewelers normally raise their prices during the drowsy summer months so that they then have room to "discount" them in the fall and holiday selling season (retail regulations suggest that a merchant must offer goods at “regular retail” prices for a period of time before they can claim an “honest” discount).

The graph below indicates the changes in the JCPI over the past two years. There was a great deal of volatility for most of the period, with a low point reached in May 2014.

Outlook – Impact Of Eventual Rise In Interest Rates

Retail jewelers can be expected to keep raising prices in order to give themselves room to reduce them later in order to attract customers as the Christmas sales season gets started.

The U.S. economic recovery remains broadly on track, while the overall inflationary outlook is in check. The Federal Reserve is now saying that interest rates will rise sooner rather than later, indicating that the U.S. central bank sees strengthening economic activity.

However, since much of the rise in retail sales may be attributed to the feel-good factor deriving from rising house and stock prices, the rise in interest rates when it comes will have a consequent impact on the housing and stock markets which are likely to not look kindly on the increase in rates.

The full analysis of the jewelry sales data is available to IDEX Online Research subscribers and IDEX Online members. Click here for more information on how to subscribe or become a member.