U.S. Specialty Jewelers: Still A Good Market Niche

September 27, 16

(IDEX Online) – Each month, IDEX Research reports sales for the U.S. jewelry industry. And each month it seems we say almost the same thing: specialty jewelers are losing market share.

Does that mean the typical American jewelry store is going the way of the dinosaurs? Does it mean they’ll be gone in a few years? Despite tremendous consolidation in the retail industry – home centers, consumer electronics retailers, office supply merchants, pet supply stores, and the list goes on and on – is there a place for the independent specialty jeweler?

IDEX Research has just completed an analysis of the U.S. specialty jewelry channel of retail distribution – those retail merchants including chains and independents who generate most of their sales from jewelry. From a financial viewpoint, here are the facts:

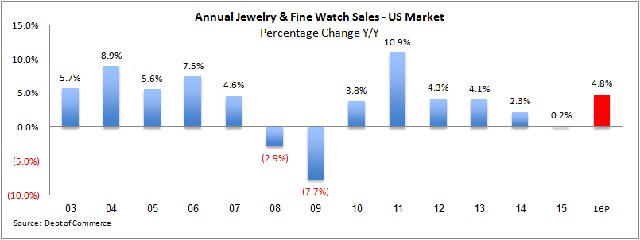

· Jewelry sales through the specialty jewelry retail channel have been about flat at $30 billion for the past decade in the U.S. market.

· The U.S. fine jewelry and watch industry has grown from about $64 billion to about $77 billion over the past decade, an increase of about 20 percent.

· The number of specialty jewelry stores fell to about 20,700 at the end of 2015, down from about 23,800 ten years ago, a decline of about 13 percent.

· Specialty jewelers’ sales per store are up as much as 40 percent over the past decade, and profits are solid.

What these statistics mean:

· While aggregate sales in the specialty jewelry channel have been static, this group of retailers is losing market share because of the rapid growth of jewelry sales through non-traditional retail channels – mostly multi-line retailers like Walmart, Costco, J.C. Penney, and others as well as online merchants.

· Despite a notable decline in the number of specialty jewelry stores, jewelry sales through this retail channel have remained static, a sign that there is market demand for jewelry sold by chain and independent jewelers.

· As a result of increased sales per jewelry store, most specialty jewelers are posting solid profits primarily as a result of economies of scale.

Specialty Jewelers Have Lost Dramatic Market Share

There’s no question that the specialty jewelry retail category is losing market share. Since the 1970s, specialty jewelers – those retail merchants including chains and independents who generate most of their sales from jewelry – have given up market share to the multi-line merchants like Walmart, J.C. Penney, Costco, and others, as the graph below illustrates. In 1971, specialty jewelers sold 73 percent of all jewelry that was bought by U.S. consumers. By 2015, their market share had dropped to below 40 percent.

Summary

In short, those specialty jewelers who remain in the business should do just fine, as long as they hold the line on costs while building sales. We won’t make a prediction for the very long term, but we believe that specialty jewelers have a solid near term future – a decade or more – in the U.S. jewelry market from a financial viewpoint.

Click here to read the full IDEX Online Research article.